what is a fit deduction on paycheck

The FICA tax and federal. S 0 Single 0 Exemptions From W-4.

Mileage Log Form For Taxes Lovely Mileage Log For Tax Deduction Template Templates Party Invite Template Christmas Party Invitation Template

After subtracting the standard deduction of 25100 your taxable income for 2021 is 64900.

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

. The employees adjusted gross pay for the pay period. Net - Earnings after taxes and deductions. As you work and pay FICA taxes you earn credits for Social Security benefits.

Jury - Jury duty pay. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Withholding is one way of paying income taxes to the.

How much is coming out of my check. The Social Security tax and the Medicare tax. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

Payroll taxes and income tax. Deducted from each paycheck. To calculate Federal Income Tax withholding you will need.

FIT deductions are typically one of the largest deductions on an earnings statement. Of your gross wages. FIT deductions are typically one of the largest deductions on an earnings statement.

OT15 - Overtime pay at 15 times your regular pay rate OnCall - On-call pay. The employee can adjust the FIT deduction by filing a W-4 however paying below true tax liability may result in a fine when filing taxes. FIT deductions are typically one of the largest deductions on an earnings statement.

A copy of the tax tables from the IRS in Publication 15. Multiply one withholding allowance for your payroll period see Table 5 below by the number of allowances the employee claims. FIT Federal Income Tax.

Of your gross wages goes to Social Security tax 145. What is fit WH on my paycheck. FIT is withheld from an employees paycheck based on the amount of their federal taxable wages.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. How do you calculate fit tax. FIT deductions are typically one of the largest deductions on an earnings statement.

FICA taxes are payroll taxes and they are a flat 62 social security tax and 145 medicare tax. Goes to Medicare tax. Make sure you have the table for the correct year.

Some are income tax withholding. FICA would be Social Security and Medicare which are not deductions nor credits on your income tax return. Reg Pay - Regular pay - hourly.

In California the State Disability Insurance SDI could be used as a Schedule A. Money may also be deducted or subtracted from a paycheck to pay for retirement or health benefits. FITW is an abbreviation for federal income tax withholding Youll sometimes see it on payroll stubs to identify your withholding deductions.

Fit deductions are typically one of the largest deductions on an earnings statement. FIT deductions are typically one of the largest deductions on an earnings statement. Fit stands for federal income tax.

Employees generally receive a paycheck along with additional information an earnings statement explaining how the amount on the check was calculated. Employers withhold or deduct some of their employees pay in order to cover. FIT represents thededuction from your gross salary to pay federal withholding also known as income taxes.

Federal income tax FIT is withheld from employee earnings each payrollIts calculated using the following information. Federal income tax deduction can be abbreviated FIT deduction. Is FICA and fit the same.

Youre not required to match this deduction. The Taxes Are Separate The FICA tax is actually made up of two separate taxes. PTO - Personal time off or paid time off.

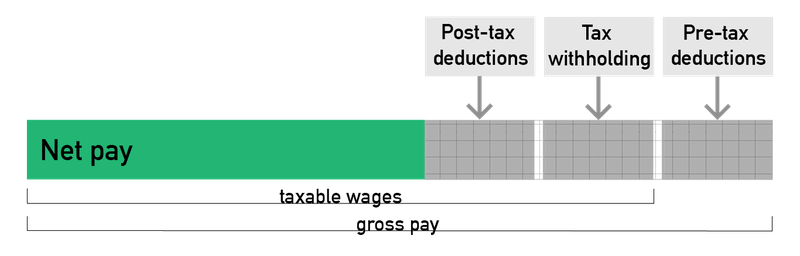

Understanding paycheck deductions What you earn based on your wages or salary is called your gross income. The FIT deduction on your paycheck represents the federal tax withholding from your gross income. FIT deductions are typically one of the largest deductions on an earnings statement.

The employees fit amount per paycheck of 39039 reduces by 15385 for a new lower fit of 23644 per pay. The amount of money you. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

While the task of figuring out FIT withholdings for your employees may seem tricky with the help of Block Advisors payroll service or payroll software like Wave your payroll to-dos just got easier. The Federal Income Tax is progressive so the amount will vary based on the projected annual income paid by that employer to you. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes. Deduction code crosswalk last update 09042019 page 3 of 6 deduction code description of deduction code amount pre or post tax deduction pay cycle lmins liberty mutual insurance as requested post tax 2 nd medee medicare employee 145 of gross wages post tax every meder medicare employer 145 of gross wages post tax every medrm. These items go on your income tax return as payments against your income tax liability.

What is a FIT-S-O payroll deduction. Misc - Miscellaneous pay pay they dont have a code for Move Rem - Move reimbursement. FIT represents the deduction from your gross salary to pay federal withholding also known as income taxes.

How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. That puts you in the 12 tax bracket. The employees W-4 form and.

FIT deductions are typically one of the largest deductions on an earnings statement. Additional Medical Tax also applies to certain levels of railroad retirement compensation and self-employment income. TDI probably is some sort of state-level disability insurance payment eg.

Federal Income Tax is withheld from your paycheck based on the amount of income you earn in each pay period. Your nine-digit number helps Social Security accurately record your covered wages or self-employment. This income is added to an employees gross wages so employment taxes can be withheld.

Calculate Federal Income Tax FIT Withholding Amount. To calculate your tax bill youll pay 10 on. Federal income tax deduction refers to the amount of federal income taxes withheld from an employees paycheck each pay cycle.

Starting with the pay period in which an individuals earnings exceed 200000 you must begin deducting 09 from his or her wages until the end of the year. How much you can expect to come out of your paycheck in federal income taxes depends on your age filing status and level of income you earn. Imputed income is the value of non-monetary compensation given to employees in the form of fringe benefits.

What Are Payroll Deductions Article

/payslip-172857080-0581fc5203d742cbaa52b248e8de2471.jpg)

Payroll Deduction Plan Definition

Pin On Beautiful Professional Template

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

Understanding Your Paycheck Credit Com

Online Custom Pay Stubs Online Custom Pay Stub Generator Payroll Template Paying Custom

/Paycheck_AdobeStock_154492502_Editorial_Use_Only-b62ac70013ec4e13b3e2a73be5e9c239.jpeg)

Gtl Group Term Life On A Paycheck

Paycheck Protection Loans Keeping People Employed Https Www Floridarealtors Org News Media News Articles 2020 03 Paycheck Good Credit Secured Loan Investing

What Are Payroll Deductions Article

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Job Description Template Checklist Template Resume Template

Understanding Your Paycheck Paycheck Understanding Yourself Understanding

Payroll Deduction Form Template Google Docs Word Apple Pages Template Net Payroll Deduction Templates

A Small Business Guide To Payroll Deductions In 2022 The Blueprint

Federal Income Tax Fit Payroll Tax Calculation Youtube

Employee Life Insurance Employee Benefit Benefit Program Business Insurance

Understanding Your Paycheck Stub Information Earnings Deductions How To Read Your Pay Stub Iris Fmp

Explore Our Example Of Salary Pay Stub Template Payroll Template Quickbooks Templates